What is a Credit Card?

A credit card is a physical card that gives you, the cardholder, a revolving line of credit to borrow funds to pay for different types of goods and services. Credit cards require that cardholders pay back the borrowed money, plus any applicable interest for a payment made past the due date. Some cards may also charge an annual fee. Some of the most common credit card servicers in the United States are VISA, American Express, Discover, and Mastercard. However, there are many others including ones that are issued by credit unions and banks.

Credit cards may be especially useful if you want to pay for things when your credit union or bank account balance is low or you have a large purchase to make and want to take advantage of a no-interest introductory period.

Different Types of Cards

Most businesses let customers make purchases with credit cards, as well as debit cards or prepaid cards. Even though you use the cards similarly in a transaction, they have key differences. When you use a debit card, you withdraw funds that you deposited into a checking account. When you use a credit card, you borrow money to complete the transaction, and the issuer typically charges you interest if you don't pay the money back by the next statement period.

Credit Cards

With a credit card, you borrow money that must be paid back. If the balance is not fully paid by the due date, you will incur interest charges and possible fees. Credit cards can help build credit history when used responsibly and may offer additional consumer protections for purchases. Your eligibility for certain credit cards and the interest rate you’re offered may depend on your credit score range.

Debit Cards

A debit card is directly linked to your credit union or bank account, so money is deducted immediately when you make a purchase. While great for everyday purchases, debit cards are considered less beneficial than credit cards for major purchases or buying items online, as they offer more limited protections in cases of unauthorized transactions or disputes.

Prepaid Cards

Prepaid cards are not tied to a bank or credit union account. With a prepaid card, you spend money that you previously loaded onto the card. Prepaid cards include “general purpose reloadable” (GPR) cards, which carry the logo of a payment network (such as Visa or MasterCard) and can be used wherever that network is accepted. Other examples of prepaid cards include store gift cards and payroll cards for employers to deposits your paycheck.

Rewards Credit Cards

Rewards credit cards offer benefits each time you make a purchase with your credit card. Rewards may include earning cash back, travel rewards, or store credits. These cards generally require good credit to obtain them and are best suited for those who pay off their balance in full each month to avoid interest charges and ensure that you reap the full rewards.

Understand Your Credit Card Statement

Review the credit card statement sections to learn about the different sections of a credit card statement and familiarize yourself with common terms and information that appear on your monthly statement.

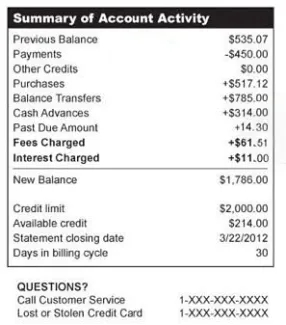

Summary of Account Activity: This section includes a summary of the transactions on your account like payments, credits, purchases, balance transfers, cash advances, fees, interest charges, and amounts past due. It will also show your new balance, available credit (your credit limit minus the amount you owe), and the last day of the billing period (payments or charges after this day will show up on your next bill).

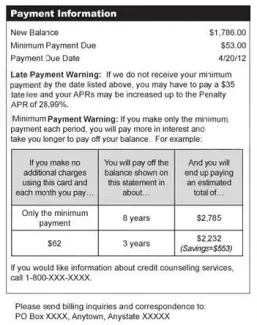

Payment information: Your total new balance, the minimum payment amount (the least amount you should pay), and the date your payment is due. A payment generally is considered on time if received by 5 p.m. on the day it is due. If mailed payments are not accepted on a due date (for example, if the due date is on a weekend or holiday), the payment is considered on time if it arrives by 5. p.m. on the next business day.

Example: if your bill is due on July 4th and the credit card company does not receive mail that day, your payment will be on time if it arrives by mail by 5 p.m. on July 5th.

Late Payment Warning: This section states any additional fees and the higher interest rate that may be charged if your payment is late.

Minimum Payment Warning: This section offers an estimate of how long it can take to pay off your credit card balance if you make only the minimum payment each month, and an estimate of how much you likely will pay, including interest, in order to pay off your bill in three years (assuming you have no additional charges). For other estimates of payments and timeframes, see the Credit Card Repayment Calculator.

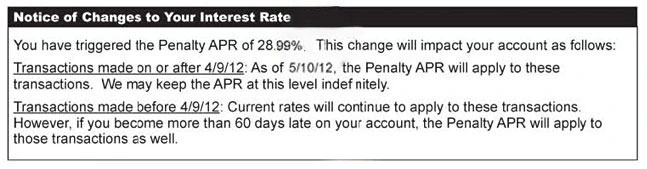

Notice of Changes to Your Interest Rate: If you trigger the penalty rate (for example, by going over your credit limit or paying your bill late), your credit card company may notify you that your rates will be increasing. The credit card company must notify you at least 45 days before your rates change.

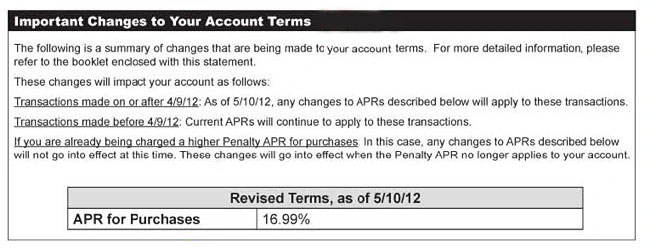

Important Changes to Your Account Terms: If your credit card company is going to raise interest rates or fees or make other significant changes to your account, it must notify you at least 45 days before the changes take effect.

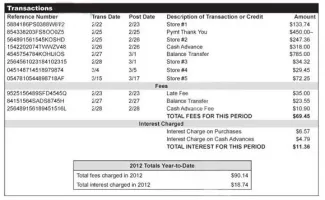

Transactions: A list of all the transactions that have occurred since your last statement (purchases, payments, credits, cash advances, and balance transfers). Some credit card companies group them by type of transactions. Others list them by date of transaction or by user, if there are different users on the account. Review the list carefully to make sure that you recognize all of the transactions and that there are no unauthorized transactions or other problems.

Fees and Interest Charges: Credit card companies must list the fees and interest charges separately on your monthly bill. Interest charges must be listed by type of transaction (for example, you may be charged a different interest rate for purchases than for cash advances).

Year to Date Totals: The total that you have paid in fees and interest charges for the current year. You can avoid some fees, such as over-the-limit fees, by managing how much you charge, and by paying on time to avoid late payment fees.

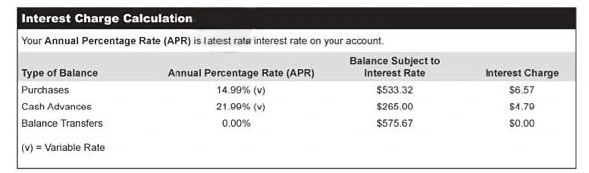

Interest Charge Calculation: A summary of the interest rates on the different types of transactions, account balances, the amount of each, and the interest charged for each type of transaction.

Unauthorized Transactions

Unauthorized charges could be fraudulent, made by someone who obtained your card number. But they could also be charges made by a legitimate merchant and without your approval. Review the Transactions section of your credit card statement carefully each month to spot potential issues.

Your liability for losses is limited to a maximum of $50 if your credit card is lost or stolen, although industry practices may further limit your losses.

Deceptive Recurring Charges

Recurring charges often apply to goods or services you never intended to accept beyond a free trial or one-time purchase. In this case, you may have forgotten to cancel the subscription, found the opt-out process confusing or difficult to understand, or the vendor ignored your order not to continue beyond the trial period.

Federal Laws that Protect Cardholders

Several credit card laws and regulations protect you from unfair practices, give you the right to dispute charges on your credit card, and allow you to file a complaint with your credit card company. In 1974, the Equal Credit Opportunity Act (ECOA) emerged as a groundbreaking shield against discrimination in the realm of credit. The ECOA is a vital piece of legislation designed to protect consumers from discrimination in any aspect of the credit application process. ECOA prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age, or receipt of public assistance.

Frequently Asked Questions

Revolving and installment credit are two different types of credit that work in distinct ways. Installment loans and revolving credit are both important parts of your credit history.

- Revolving Credit: You have a credit limit that you can borrow against repeatedly. As you repay the borrowed amount, your available credit is replenished, allowing you to borrow again. You can make minimum monthly payments, but there is no fixed end date for repayment in full.

- Installment Credit: You receive a lump sum of money upfront and repay it in fixed installments over a set period. You make regular, fixed payments until the loan is fully repaid. The loan term is predetermined.

Understanding this distinction is important because while installment loans do not impact your credit utilization ratio, they still pay a role in your overall credit profile and can influence your credit score through factors like payment history and the total amount of debt you have. Revolving credit can offer more financial clues to your behavior because it shows how you manage varying expenses over time. Lenders can see if you consistently pay off your balance or if you carry a high balance from month to month; this can tell a lot about how you will manage future debt that you don’t have yet.

A hard inquiry means that someone has requested to look at your credit report to determine your creditworthiness. Hard inquiries typically occur when you apply, for instance, for a new credit card, car loan or mortgage. Hard inquires will show up on your credit report and may stay there for two years. Additionally, hard inquiries may lower your credit score.

Paying only the minimum payment on a credit card often doesn’t significantly decrease the amount due because of the way interest and fees are applied. Here are the main reasons:

- Interest Accumulation - When you make only the minimum payment, a large portion of that payments goes towards interest rather than the principal balance. This means the actual debt amount decreases very slowly.

- Fees – If your account has any fees, such as late payment fees or annual fees, these can add to your balance. Paying only the minimum may not cover these fees causing your balance to remain high or even increase.

- High Interest Rates - Credit cards often have high interest rates. Even if you make the minimum payment, the interest charged on the remaining balance can be substantial, offsetting the reduction in the principal.

- Continued Spending - If you continue to use the credit card while making only minimum payments, new charges will add to your balance, making it difficult to see a decrease.

Example: If you have a balance of $1,000 with an interest rate of 13% and make a minimum payment of 2% ($20), a significant portion of that $20 will go towards interest, leaving a small amount to reduce the principal.