Money Basics Guide to Savings and Checking Accounts

About the Money Basics Guide Series

Welcome to the Money Basics Guide to Savings and Checking Accounts. The Money Basics Guides are a series of learning tools developed to assist financial educators, credit unions, and other financial institutions in promoting financial literacy in their communities. These guides are also for everyday people who want to build their financial knowledge with practical skills they can use to manage their money.

Future guides will cover the basics of common financial topics, as well as emerging issues of consumer finance.

The Money Basics Guide to Savings and Checking Accounts is a great resource for group and individual learning. Whether you’re a financial educator building workshops for those you serve or an individual focused on building your own financial knowledge and capability, these lessons and activities are for you.

Introduction to the National Credit Union Administration

The National Credit Union Administration (NCUA) is an independent federal agency created by the U.S. Congress to insure deposits at federally insured credit unions, protect the members who own credit unions, and charter and regulate federal credit unions. Part of our mission is to encourage financial literacy because we understand that when credit union members and consumers are more educated and informed, they’re better equipped to make the best financial decisions for themselves and their families. The NCUA offers a variety of tools to support credit unions in their financial literacy efforts, as well.

Icon Key

Throughout the Money Basics Guide to Savings and Checking Accounts, you will find icons to help you identify important information. Keep an eye out for the following:

Tip

![]() Tips provide you with additional need to know information about a topic and may offer suggestions for next steps.

Tips provide you with additional need to know information about a topic and may offer suggestions for next steps.

Fact

![]() Facts highlight valuable data and research to help you understand the impact of a topic on consumers.

Facts highlight valuable data and research to help you understand the impact of a topic on consumers.

Definition

![]() Definitions help you to learn important financial language.

Definitions help you to learn important financial language.

Test Your Knowledge Activity and Activity

Activity icons signal there is an action you can take individually or in a group to build your comprehension on a section topic.

![]() Test Your Knowledge Activity

Test Your Knowledge Activity

![]() Activity

Activity

Throughout the Money Basics Guides you will find the following icons which tell you what skills you will acquire:

![]() Building Knowledge

Building Knowledge

![]() Building New Habits

Building New Habits

![]() Building for the Future

Building for the Future

![]()

Section I: Overview of Savings and Checking Accounts

Savings and checking accounts are typically the first step in establishing a financial foundation for consumers. These accounts are held at financial institutions that allow you to deposit and withdraw money while keeping a record of what comes in and goes out.

There are two main types of financial institutions in the United States: banks and credit unions. Most consumers lump these two types of financial institutions together because they both:

- Allow you to deposit and withdraw money.

- Hold and safeguard your money.

- Invest your money while it sits in your accounts.

- Offer loans and other financial services and products.

- Operate with a federal or state charter

- Protect the money in your accounts for up to $250,000 per individual account.

![]() Tip: The FDIC and NCUA are federal financial regulators that insure your accounts. Look for their seal on checks and other official documents.

Tip: The FDIC and NCUA are federal financial regulators that insure your accounts. Look for their seal on checks and other official documents.

That said, credit unions have some unique features and values that are important to be aware of.

- Credit unions are owned and controlled by their members, who use their services, and often have a shared interest or common bond.

- A volunteer board of directors is elected by members to manage a credit union.

- Credit unions operate to promote the well-being of their members, not investors.

- Typically, credit unions have lower fees.

- Often, credit unions have lower interest rates on loans.

- Profits made by credit unions are returned back to members in the form of reduced fees, higher savings rates and lower loan rates.

- Many credit unions participate in the shared branch networks to give members access to thousands of branches and free ATMs across the country.

When you sign up for a checking or savings account, you are entering into an agreement with a credit union or bank that allows them to hold on to your money, loan and invest it, and sometimes charge certain fees for maintaining the account. In return, you get a safe place to store your money, access your funds (through ATMs, debit cards, checks, etc.), and other benefits.

![]() Tip: You may hear your credit union refer to your checking account as a share draft account. While this account operates the same as a bank checking account, share accounts indicate that you are a partial owner of your credit union, unlike bank account holders who are customers.1

Tip: You may hear your credit union refer to your checking account as a share draft account. While this account operates the same as a bank checking account, share accounts indicate that you are a partial owner of your credit union, unlike bank account holders who are customers.1

![]() Fact: When you put money into an account, it doesn’t sit untouched. Your credit union uses that money to make investments and provide other members loans. In turn, they make profits off of loan interest and investment growth.

Fact: When you put money into an account, it doesn’t sit untouched. Your credit union uses that money to make investments and provide other members loans. In turn, they make profits off of loan interest and investment growth.

Note: While it may seem like your money is moving around and being used by your credit union, you always have access to it. The financial market is cyclical and interconnected, but credit unions ensure your money is always available.

Section II: What’s the difference between a savings account and a checking account?

Savings accounts

Opening a savings account is typically the first step for a consumer looking to join a credit union. Similar to checking accounts, savings accounts are deposit accounts managed by your credit union. However, the primary goal of a savings account is to help you put aside money for specific goals, long-term goals, like retirement goals, and emergencies. Think of your savings account as the adult version of a child’s piggy bank. The money in them is not for going out to dinner or splurging on a new game, but instead, this is the money you put away in case your water heater or roof needs replacing, your car needs repairs, or you’re saving for a home or family vacation.

![]() Fact: In a 2021 report by the Board of Governors of the Federal Reserve System, it was found that 30 percent of U.S. adults would either not be able to cover or would have to sell something in order to cover an unexpected expense of $400.

Fact: In a 2021 report by the Board of Governors of the Federal Reserve System, it was found that 30 percent of U.S. adults would either not be able to cover or would have to sell something in order to cover an unexpected expense of $400.

While you can withdraw money from savings accounts when needed, many credit unions and banks have monthly limits on how often and how much you can take out. This helps you to think twice about withdrawing cash from your savings. Additionally, many credit unions offer incentives to encourage you to save. Those incentives can be rewards, special programs, and even cash.

![]() Tip: You may have heard of the term “high yield savings” or “returns” on your savings account before. These terms refer to savings accounts that “grow” your money over time while the money sits in the account. While savings accounts can increase your balance without you doing anything, the monetary increase is nominal. Savings accounts are not investment accounts, and they won’t make you rich. If you want to do more than save and build wealth, consider investing. The Securities and Exchange Commission offers useful tools and resources to help you get started.

Tip: You may have heard of the term “high yield savings” or “returns” on your savings account before. These terms refer to savings accounts that “grow” your money over time while the money sits in the account. While savings accounts can increase your balance without you doing anything, the monetary increase is nominal. Savings accounts are not investment accounts, and they won’t make you rich. If you want to do more than save and build wealth, consider investing. The Securities and Exchange Commission offers useful tools and resources to help you get started.

![]() Activity: Consider the last time you had an unexpected financial emergency. What did you do to pay for it? Can you cover that expense today? What would you do if you faced more than one emergency at the same time? How could having a savings account help?

Activity: Consider the last time you had an unexpected financial emergency. What did you do to pay for it? Can you cover that expense today? What would you do if you faced more than one emergency at the same time? How could having a savings account help?

Checking accounts

Checking accounts are typically used for everyday expenses. You use these accounts to buy groceries, gas, movie tickets, and your morning coffee. You may also use these accounts to pay bills like your rent or mortgage, gas, electric, or car payments. Some people find it easier to manage their money by having more than one checking account so that money is set aside for bills in one account and miscellaneous expenses can come out of another account.

Checking accounts also come with certain benefits that make managing your money easier. The benefits of these types of accounts include:

![]() Easy access to your money: Most checking accounts provide diverse access to your money via ATMs, branch locations, and mobile banking tools.

Easy access to your money: Most checking accounts provide diverse access to your money via ATMs, branch locations, and mobile banking tools.

![]() ATM cards: Checking accounts come with ATM cards that allow you to get cash and make deposits at walk-up and drive-through kiosks, and indoor branches.

ATM cards: Checking accounts come with ATM cards that allow you to get cash and make deposits at walk-up and drive-through kiosks, and indoor branches.

![]() Debit cards: A debit card allows the account owner to access their funds electronically. Debit cards may be used to obtain cash from ATMs or purchase goods or services using point-of-sale (cash-less) systems using a debit card involves immediate debiting or crediting of consumers’ accounts.2 While these cards allow you to pay for things without physical money, the card will be declined if there’s not enough money in your account to cover a purchase. If you don’t want that to happen, you can explore opting into an overdraft protection program or establishing a line of credit with your credit union.

Debit cards: A debit card allows the account owner to access their funds electronically. Debit cards may be used to obtain cash from ATMs or purchase goods or services using point-of-sale (cash-less) systems using a debit card involves immediate debiting or crediting of consumers’ accounts.2 While these cards allow you to pay for things without physical money, the card will be declined if there’s not enough money in your account to cover a purchase. If you don’t want that to happen, you can explore opting into an overdraft protection program or establishing a line of credit with your credit union.

![]() Statements: Under federal law, credit unions make monthly statements available to all account holders and serve as a record of how your money exists within your account. These statements show your balance, deposits, purchases, bills paid, and withdrawal history.

Statements: Under federal law, credit unions make monthly statements available to all account holders and serve as a record of how your money exists within your account. These statements show your balance, deposits, purchases, bills paid, and withdrawal history.

![]() Transfers: Many credit unions allow you to transfer funds to other accounts, account holders, and accounts at other financial institutions.

Transfers: Many credit unions allow you to transfer funds to other accounts, account holders, and accounts at other financial institutions.

![]() Tip: These transfers may be free but some have fees. Be sure to check with the credit union.

Tip: These transfers may be free but some have fees. Be sure to check with the credit union.

Additional Product Offerings

![]() Line of credit: A line of credit is a pre-approved loan authorization with a specific borrowing limit based on creditworthiness. A line of credit allows borrowers to obtain several loans without re-applying each time as long as the total of borrowed funds does not exceed the credit limit.3

Line of credit: A line of credit is a pre-approved loan authorization with a specific borrowing limit based on creditworthiness. A line of credit allows borrowers to obtain several loans without re-applying each time as long as the total of borrowed funds does not exceed the credit limit.3

Similar to traditional loans, you pay interest only when you borrow on that line of credit. You can take out as little or as much as you want within the limit of your line of credit. And as long as you follow the terms, like paying off your debt on time, you can borrow again and again.4

![]() Interest rate: The rate paid by a borrower to a credit union in exchange for using the credit union’s money for a certain period. Interest is paid on loans or debt instruments, such as notes or bonds, either at regular intervals or as part of a lump sum payment when the issue matures.5

Interest rate: The rate paid by a borrower to a credit union in exchange for using the credit union’s money for a certain period. Interest is paid on loans or debt instruments, such as notes or bonds, either at regular intervals or as part of a lump sum payment when the issue matures.5

![]() Credit cards: Some credit unions offer account holders credit cards. A credit card allows the card holder to conveniently make purchases electronically and be billed later. Most credit cards allow the balance to be carried over from one billing cycle to the next. However, the card holder usually has to pay interest on that balance. The card holder will likely have to pay at least acertain amount of the balance due each billing cycle. Credit cards have a set credit limit that’s established when the account is opened and may increase or decrease over time. Using a credit card involves potential fees and penalties (that can be very high) depending on the cardholder’s payment history. Not paying your credit card balance on time can seriously affect your credit score and borrowing power.6

Credit cards: Some credit unions offer account holders credit cards. A credit card allows the card holder to conveniently make purchases electronically and be billed later. Most credit cards allow the balance to be carried over from one billing cycle to the next. However, the card holder usually has to pay interest on that balance. The card holder will likely have to pay at least acertain amount of the balance due each billing cycle. Credit cards have a set credit limit that’s established when the account is opened and may increase or decrease over time. Using a credit card involves potential fees and penalties (that can be very high) depending on the cardholder’s payment history. Not paying your credit card balance on time can seriously affect your credit score and borrowing power.6

![]() Lending: Loans are a benefit available to account holders in good standing and with a healthy credit history. Credit unions may lend you money to purchase a home or car, to pay off debts, or for other big purchases—at a cost known as interest. Your loan contract is a written agreement between you as the borrower and the lender in which the terms and conditions of the loan (interest rate and pay-off date) are established.7

Lending: Loans are a benefit available to account holders in good standing and with a healthy credit history. Credit unions may lend you money to purchase a home or car, to pay off debts, or for other big purchases—at a cost known as interest. Your loan contract is a written agreement between you as the borrower and the lender in which the terms and conditions of the loan (interest rate and pay-off date) are established.7

![]() Tip: While credit unions often have lower interest rates, you are always encouraged to shop around and compare rates.

Tip: While credit unions often have lower interest rates, you are always encouraged to shop around and compare rates.

![]() Test your knowledge activity:

Test your knowledge activity:

- Which two federal agencies protect the money in your accounts?

- How much of your money is protected in each account?

- What type of financial institution is owned and operated by its members?

![]() Test your knowledge activity:

Test your knowledge activity:

You’ve recently started a new business that will require you to have large sums of cash available from time to time. Your credit union offers lines of credit, credit cards, and loans. What would be your best option?

- Will you have the money to pay off the debt by the specified payoff date?

- Will you need sums of money regularly? Or is this a one-time need?

- Which option offers you the best interest rate?

- Which option offers the most flexibility?

Answer: Choosing how to borrow money is a personal choice that only you can determine. However, a line of credit may be the best option in this scenario because it offers more flexibility. For example, a line of credit will allow you to take out several loans without reapplying, you can take out different amounts as long as they fit into the loan limit, and you’re not likely to have a short payback window that can easily be missed.

Why having a savings and checking account is important

While not having an account at a financial institution might not seem like a big deal, it can have serious implications that impact your financial well-being. According to the FDIC, approximately 5.9 million U.S. households were unbanked in 2021. Unbanked and underbanked individuals often find themselves using riskier alternatives to manage their finances and borrow money. These alternatives can cost consumers big bucks in check cashing fees and high-interest payday loans.

In addition, unbanked consumers:

- May not have a safe place for their money;

- Have no protections if their money is stolen or they are defrauded;

- Have no official record of how much money they have or have spent;

- Can’t participate in the financial market and build wealth safely.

Having a savings and checking account at a credit union is essential to fully and safely participate in the economic system, so all consumers should shop around for the credit union that meets their needs.

Section III: Starting a savings or checking account

Once you decide to start a savings and checking account, consider the type of credit union you would like to manage your money. Shop around. Do your research. And because many credit unions were established by community members with the same goals or values as you, find out if your employer, social or religious affiliation, or military background may allow you to join a credit union.

Things to consider when looking for a credit union or bank

- Are they accessible? Do they have branches in my community?

- Do they have surcharge-free ATMs near me?

- Do they charge fees for transfers or going below a certain monthly balance?

- Do they have a monthly maintenance fee?

- How quickly do checks clear?

- Do they have mobile banking services?

- Will I get alerts if there is a low balance or suspicious account activity?

- Do they have 24-hour service by phone or chat?

- Do they have multilingual services? □ Do they have services for members with disabilities?

- Do they offer remittances (also known as money transfers) if I need to send money internationally?

- What is the cost of an overdraft fee? □ Do they offer peer-to-peer payment services if I want to send money to another account holder or someone outside the financial institution?

- Do they include members or consumers in their business model?

- Do they value my business?

![]() Tip: While many credit unions allow you to join online, some may require you to come into a branch. Call ahead to make an appointment and ask what you must bring. Requirements

Tip: While many credit unions allow you to join online, some may require you to come into a branch. Call ahead to make an appointment and ask what you must bring. Requirements

What do you need to open a savings or checking account?

- 2 Forms of Identification

- A government issued picture ID (ex: Driver’s License)

- An additional item such as a social security card, birth certificate, or bill in your name.

- Application

- Initial deposit

Starting an account for a minor

Starting a savings or checking account is a great way to introduce young people to how to manage their finances. Help them start their financial journey by opening an account that allows them to save for a goal, track their deposits, and learn the value of thrift. Many credit unions offer youth savings accounts, so inquire to learn more.

When starting an account for a minor, ask your credit union what you need. Typically, you’ll be required to provide your identification and identification for the minor, the application, and the initial deposit.

Section IV: Maintaining savings and checking accounts

Understanding how to maintain your accounts is vital to staying in good standing with your credit union and ensures that you don’t incur unexpected fees and lending obstacles.

If your savings and checking account has a minimum balance requirement, you mustn’t go below it. Otherwise, you may get charged a fee. As well, when using debit cards, it’s important to remember that they are not credit cards. If you swipe to make a purchase but don’t have enough money to cover it, two things can happen:

- Your card will be declined.

- If you’ve opted into overdraft protection, your credit union will cover the overdraft on your account. However, this service will typically involve a fee and be limited to a preset maximum amount.8

![]() Tip: Overdraft fees can add up if you mistakenly make multiple purchases and don’t have the money in your account to cover them. Pay attention to your account balances by setting up mobile alerts that warn you when your balance is low. And consider linking your accounts so that money can be taken from other accounts to cover what you may otherwise overdraw.

Tip: Overdraft fees can add up if you mistakenly make multiple purchases and don’t have the money in your account to cover them. Pay attention to your account balances by setting up mobile alerts that warn you when your balance is low. And consider linking your accounts so that money can be taken from other accounts to cover what you may otherwise overdraw.

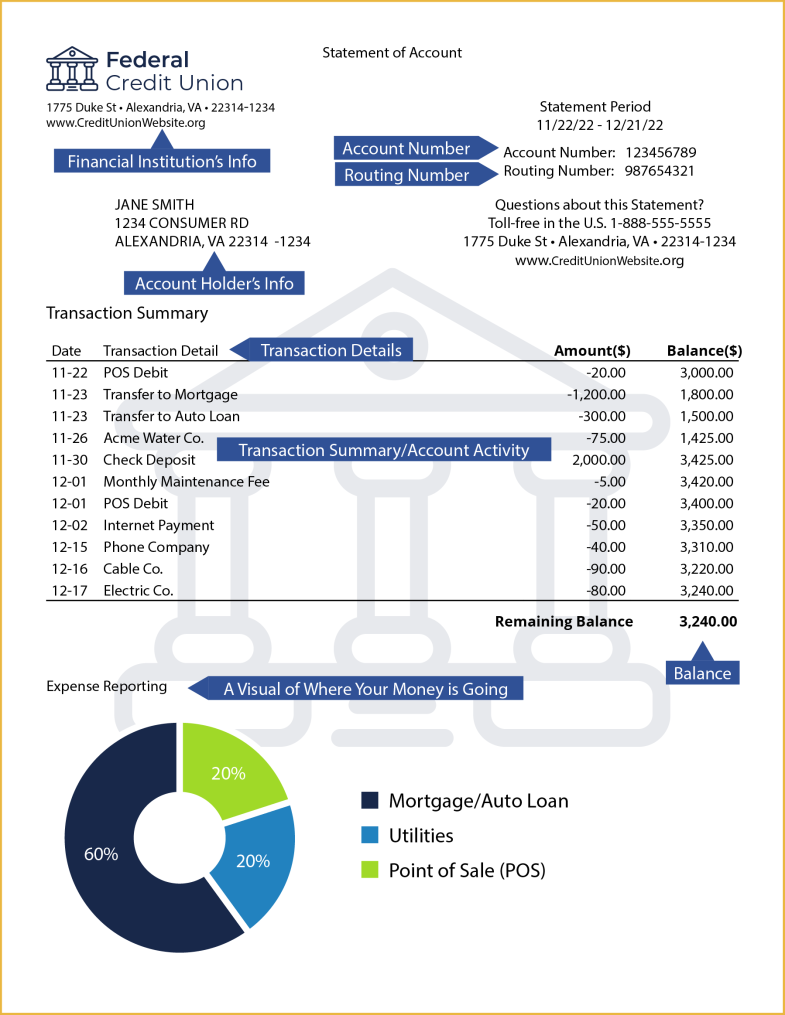

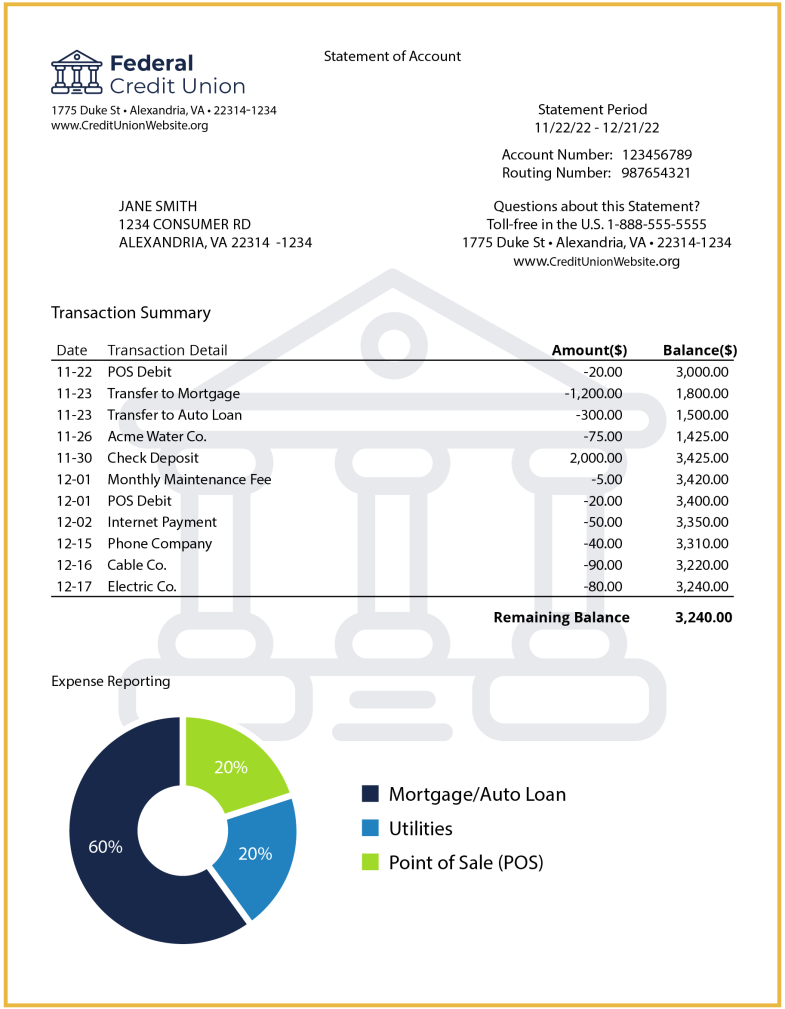

Monthly account statements

Knowing how to read your monthly statement is essential in maintaining your accounts. These statements help you track where your money is and how it’s being spent. They can prove invaluable when you suspect that a mistake has been made by your financial institution or a service that’s billed you, they can help you track if there’s been suspicious activity, and they can also help you to see where you are overspending.

Get familiar with your monthly account statements.

![]() Activity: Find and circle the most recent check deposit, account number, $20 debit transaction, and your account balance on December 15.

Activity: Find and circle the most recent check deposit, account number, $20 debit transaction, and your account balance on December 15.

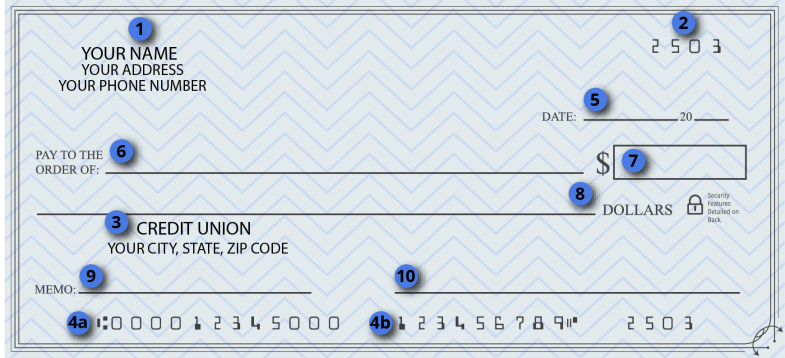

Checks

While checks are becoming less commonly used in the new world of digital banking, they are still an important tool to familiarize yourself with. Checks are a written order that instructs a credit union to pay a specified amount of money from the member’s account to the person named on the check or, if a specific person is not named (For example, written to “Cash”), to whoever bears the check to the institution for payment.9

You can use a check to pay bills like your mortgage or a child’s tuition. And some retail businesses will allow you to purchase items such as groceries and clothing with a check as long as you have your ID, but this has become less common, so it’s a good idea to ask shopkeepers first.

Often checks are used to deposit money into your accounts. If you aren’t signed up for direct deposit, your employer will pay you with a physical check. You can take that check to a branch location and many ATM kiosks to be deposited into your account. There may be a delay in the availability of funds after the check deposit has been made.

![]() Direct Deposit: A payment that is electronically deposited into an individual’s account at a depository institution.

Direct Deposit: A payment that is electronically deposited into an individual’s account at a depository institution.

Similarly, if someone writes a check to you, you can deposit the check into your account or request the cash from a branch teller.

![]() Tip: Check-cashing services always costs you money. Depositing checks into a checking account is free and, therefore, the best option.

Tip: Check-cashing services always costs you money. Depositing checks into a checking account is free and, therefore, the best option.

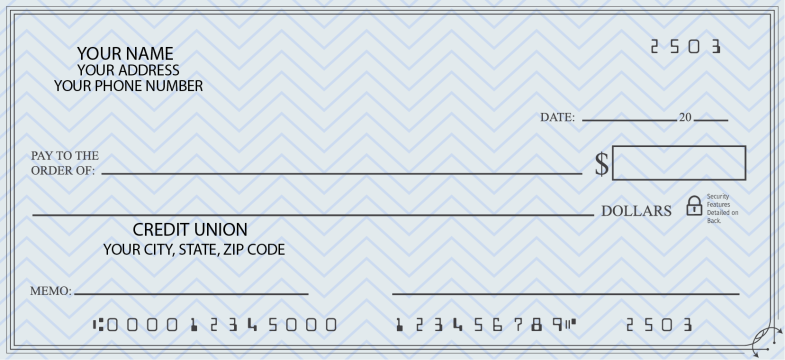

Understanding a check

Credit unions make checks available to account holders, usually at a cost. You can order a “book” of checks that are mailed to you. Here are the basics of a check:

- Your name and sometimes your address and phone number are included.

- The check number helps to identify which check in your checkbook has been written.

- Your credit union’s information.

- The routing number (4a) and account number (4b). These numbers help to identify the financial institution and account money is being withdrawn from.

- The date the check is written.

- The ‘Pay to the Order of” line. This is where you write the name of the person or company to whom you will give the check. After writing the name, you can draw a line to the end. This prevents anyone from adding another name to your check.

- The dollar amount of the check is written as a number, such as $19.75.

- The dollar amount of the check in words. Such as nineteen and seventy-five cents. Drawing that line prevents another person from adding a different or additional dollar amount after what you have written.

- The memo section. This area is optional. You can use this area to remind yourself why you wrote the check or to record the account number of the bill you are paying.

- The signature line is where you sign the check, indicating that you approve this payment from your account.

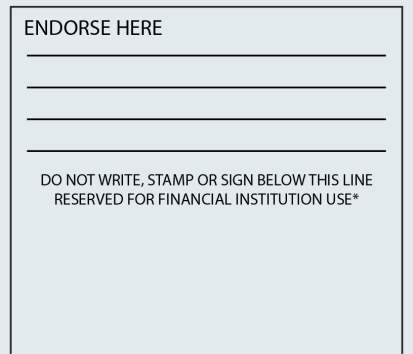

The back of your check

There is also important information printed on the back of your checks: The back of the check has an endorsement area. Endorsing a check means signing the back to make it “cashable.” For example, if you write a check to your friend, your friend would endorse the check to get the cash or deposit the amount into his or her account.

![]() Test your knowledge activity:

Test your knowledge activity:

You’ve just received your first book of checks and would like to send $25 to your nephew, who just had a birthday. Fill out the below check with the needed information.

ATM and Debit Cards

ATMs are electronic terminals that let you bank anytime, regardless of whether your credit union is open. To withdraw cash, make deposits, or transfer funds between accounts, you generally insert an ATM Card and enter your PIN. Some financial institutions and ATM owners charge a fee, particularly if you don’t have an account with them or your transactions occur at remote locations. Generally, ATMs must tell you they charge a fee and the amount on or at the terminal screen before you complete the transaction.10

These days, most credit unions offer ATM cards that are also debit cards. These cards allow you to make online and in-store purchases on the same card you use to get cash at ATM terminals. When you make a purchase with your debit card, the money comes directly from your checking account. Here’s what you need to know about these cards:

- The name and logo of your financial institution will be on your card. These cards are typically sent to you through the U.S. mail in a nondescript envelope to ensure there is less opportunity for theft and fraud.

- Your name will be listed on the front or back of the card.

- A card number will be listed on the front or back of the card. This number is typically 16 digits long, but it can vary. The first four digits are attributed to your financial institution, but the others are chosen at random to connect the bank or credit union to your account. Your card number is not the same as your account number and should be kept private.

- Cards must be replaced periodically due to account changes, loss or theft of cards, or new technology. Therefore, your card has an expiration date, and when it’s close to expiring, your financial institution will mail a new one to you. You may be asked to provide the expiration date when making online or over-the-phone purchases.

- All cards have a signature strip where you are supposed to sign your name. Many merchants will not take payments if you have not signed them, so it’s important to sign as soon as you get your card.

- When making in-person purchases, you may swipe your card using the magnetic strip located on the back of your card. This strip electronically links your card to your accounts.

- More recently, credit unions have adopted smart chips as a safer alternative to magnetic strips. These small metal chips make it harder for thieves to use stolen cards. You simply insert the chip into card readers or tap the contactless payment symbol at a cash register to make purchases.

- Cards come with a security code on the front or back. This code acts as an additional security measure in cases of fraud and is often requested when making online or over-the-phone purchases.

- Many cards have a hologram on them. This shiny, mirror-like image is a security feature to protect your card from fraud.

- On the back of your card, you may also find the contact information for your financial institution.

![]() Tip: After signing your card, if there’s room in the signature panel add “see ID”. Responsible merchants will see this and be able to confirm that you are the authorized user.

Tip: After signing your card, if there’s room in the signature panel add “see ID”. Responsible merchants will see this and be able to confirm that you are the authorized user.

![]() Test your knowledge activity:

Test your knowledge activity:

Identify five things that can be on your ATM or debit card and what they are used for.

Section V: Online Banking

Many credit unions and other financial institutions offer online and mobile banking services to account holders. These offerings allow you to manage your money from anywhere by simply signing in on a tablet, smartphone, or computer with a username or password. Online banking is an excellent resource for keeping track of your accounts, setting up recurring bill payments, and transferring money. Many credit unions offer educational resources to help you build your financial knowledge.

While online banking makes it easier for you to manage your accounts anytime and from anywhere, it can also make them susceptible to hacking and fraud. Cybercriminals comb open wi-fi networks to gain access to your login and password information. If thieves get access to your login credentials, they can wreak havoc on your finances. To protect your accounts, here are a few best practices:

- Always log in to online banking platforms from trusted and password-protected internet connections. Free public wi-fi offered in a coffee shop, library, or other public spaces is never appropriate when logging in to financial accounts.

- Make your password hard to replicate. And never write it down along with your username. If you write it down, store it safely where others can’t find it.

- Always check the URL when logging into your accounts. Scammers use phishing and pharming tactics to steal your information. They create fake URLs and websites that mirror your financial institution’s website. Once you’ve logged in with your credentials, they gain access to your account. Never click on a link that comes to you via text or email. Instead, type your financial institution’s URL into your web browser. When in doubt, you can confirm that a website is secure if there is a lock icon in the URL web browser.

- If your financial institution offers two-factor authentication, an additional layer of password protection, you should use this feature. This feature requires you to enter a one-time code each time you log in. This code will be sent to you by text, email, or phone call, adding an extra obstacle for online thieves.

![]() Tip: According to the FBI, phishing schemes often use spoofing techniques to lure you in and get you to take the bait. These scams are designed to trick you into giving valuable personal information to criminals. In a phishing scam, you might receive an email that appears to be from a legitimate business and is asking you to update or verify your personal information by replying to the email or visiting a website.

Tip: According to the FBI, phishing schemes often use spoofing techniques to lure you in and get you to take the bait. These scams are designed to trick you into giving valuable personal information to criminals. In a phishing scam, you might receive an email that appears to be from a legitimate business and is asking you to update or verify your personal information by replying to the email or visiting a website.

Pharming scams happen when malicious code is installed on your computer to redirect you to fake websites.11

Section VI: Trusted contacts and beneficiaries

Some credit unions and other financial institutions allow account holders to add a trusted contact to their account profiles. This person can act as an emergency financial contact and can step in to help protect the account holder if they cannot manage accounts for themselves.12 Having a trusted contact on your accounts is a good measure for any account holder, but it can be particularly valuable as you age or manage health challenges. When a financial institution can’t reach the account holder, a trusted contact can be contacted and help get the information back to them.

Ask your credit union about their trusted contact policy to learn more.

While no one wants to think about death, being prepared for it is crucial to financial planning. Account holders should talk to their financial institutions about adding beneficiaries to their accounts in the instance of death or incapacitation. This way, loved ones will have easier access to accounts and account information during difficult times.

Section VII: Managing issues with your credit union

Occasionally, consumers may find an issue or dispute with how their credit union has handled something. While we encourage you to work with your credit union first, you have options if a problem isn’t resolved in a manner you believe is correct or fair.

The National Credit Union Administration’s Consumer Assistance Center assists consumers in resolving disputes with credit unions and provides information about federal consumer financial protection laws and regulations. Contact the Consumer Assistance Center at 1-800-755-1030 Monday through Friday from 8 a.m. to 5 p.m. Eastern or visit MyCreditUnion.Gov/about/consumer-assistance-center.

Section VIII: Conclusion

You now know the basics to starting and maintaining a savings and checking account. What are three takeaways you learned from this guide?

We encourage you to continue building your financial knowledge by visiting MyCreditUnion.gov and by using our Money Basics Guide to Budgeting and Savings.

Sources:

2 https://mycreditunion.gov/financial-resources/glossary/d

3 https://mycreditunion.gov/financial-resources/glossary/l

4 https://www.creditkarma.com/credit-cards/i/what-is-line-of-credit

5 https://mycreditunion.gov/financial-resources/glossary/i

6 https://mycreditunion.gov/financial-resources/glossary/c

7 https://mycreditunion.gov/financial-resources/glossary/l

8 https://mycreditunion.gov/manage-your-money/credit-union-accounts-services/checking-accounts

9 https://mycreditunion.gov/financial-resources/glossary/c

12 https://files.consumerfinance.gov/f/documents/cfpb_trusted-contacts-fis_2021-11.pdf