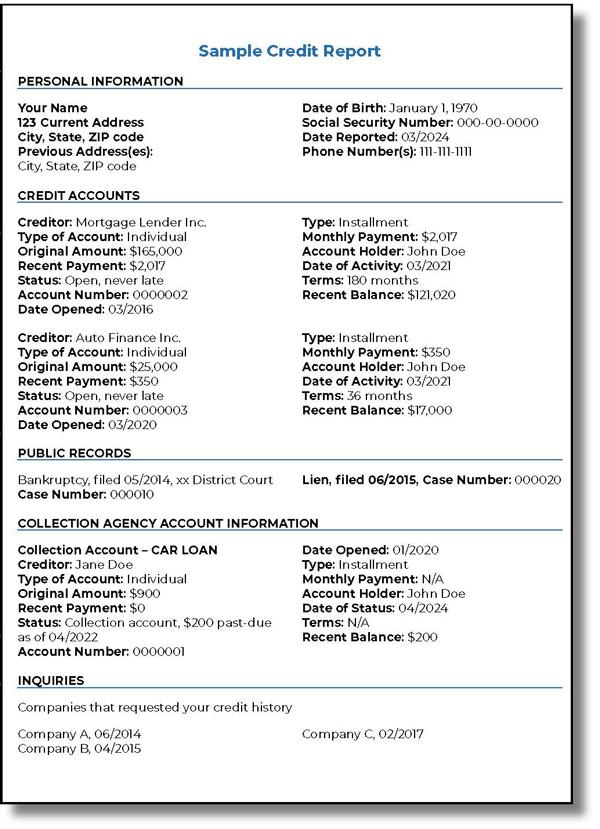

Money Basics Guide to Building and Maintaining Credit

About the Money Basics Guide Series

Welcome to the NCUA’s Money Basics Guide to Building and Maintaining Credit! The Money Basics Guides are a series of learning tools developed to assist financial educators, credit unions, and other financial institutions in their efforts to promote financial literacy in the communities they serve. These guides are also for everyday people who want to build their financial knowledge with practical skills they can use to manage their money.

Future guides will cover the basics of common financial topics, as well as emerging issues of consumer finance.

The Money Basics Guide to Building and Maintaining Credit is a great resource for group and individual learning. Whether you are a financial educator who is building workshops for those you serve or are an individual focused on building your own financial knowledge and capability, these lessons and activities can help you along the way.

Introduction to the National Credit Union Administration

The National Credit Union Administration (NCUA) is an independent federal agency created by the U.S. Congress to insure deposits at federally insured credit unions, protect the members who own credit unions, and charter and regulate federal credit unions. Part of our mission is to encourage financial literacy because we understand that when credit union members and consumers are more educated and informed, they’re better equipped to make the best financial decisions for themselves and their families. The NCUA offers a variety of tools to support credit unions in their financial literacy efforts, as well.

Icon Key

Throughout the Money Basics Guide to Savings and Checking Accounts, you will find icons to help you identify important information. Keep an eye out for the following:

Tip

![]() Tips provide you with additional need to know information about a topic and may offer suggestions for next steps.

Tips provide you with additional need to know information about a topic and may offer suggestions for next steps.

Fact

![]() Facts highlight valuable data and research to help you understand the impact of a topic on consumers.

Facts highlight valuable data and research to help you understand the impact of a topic on consumers.

Definition

![]() Definitions help you to learn important financial language.

Definitions help you to learn important financial language.

Test Your Knowledge Activity and Activity

Activity icons signal there is an action you can take individually or in a group to build your comprehension on a section topic.

![]() Test Your Knowledge Activity

Test Your Knowledge Activity

![]() Activity

Activity

Throughout the Money Basics Guides you will find the following icons which tell you what skills you will acquire:

![]() Building Knowledge

Building Knowledge

![]() Building New Habits

Building New Habits

![]() Building for the Future

Building for the Future

Section I: Credit

What is Credit?

Credit gives you the ability to borrow money and pay it back later. It allows you to get the things you need now, like a mortgage or car loan as well as other goods you may charge with a credit card, with the good faith promise that you will pay it back according to agreed terms. And like other loans, there is typically a cost for using credit in the form of fees and/or interest rates.

Why is credit so important?

Credit is important because it is a powerful tool to achieving your financial goals. It is also important because it signifies your trustworthiness when it comes to paying back your debts. Your credit history tells the story of how you manage your financial obligations and gives creditors an idea of whether you are someone who will pay them back if they lend you money. When consumers have a strong credit history, they have the power to command larger loans and higher credit limits as well as lower interest rates. But when an individual has a poor credit history, they have less lending power, accumulate more late fees, and are more likely to be charged higher interest rates when seeking different forms of credit.

Credit can influence almost every aspect of your life, not just your finances. If you have good credit, it can help you to reach your financial goals. If you have poor credit, it may prevent you from making many of your goals a reality. Most people realize that poor credit can affect their ability to obtain credit at a reasonable rate, or at all. But there are other adverse effects of poor credit and poor credit management that you may not be aware of, such as:

- Inability to qualify for a mortgage or rental lease

- Inability to get insurance or paying higher insurance rates

- Being unable to qualify for certain jobs

Before borrowing money, it’s essential to have a basic understanding of how to manage money and how credit and borrowing work. If you don’t understand these two things, you can find yourself in deep debt that can negatively impact your financial wellbeing for years. Check out the NCUA’s Money Basics Guide to Budgeting and Savings to learn more about managing your money and starting good money habits.

Types of Credit

![]() There are two types of credit: Revolving credit and Installment loans.

There are two types of credit: Revolving credit and Installment loans.

![]() Revolving credit typically comes in the form of credit cards, and it allows you to have a line of credit to make purchases with as long as you stay within your credit limit and pay your minimum balance on time. You may use this type of credit to buy anything within your credit limit. The most common items people use revolving credit for are things like groceries, gas, clothing, and other goods but some individuals also put automated bills on credit cards.

Revolving credit typically comes in the form of credit cards, and it allows you to have a line of credit to make purchases with as long as you stay within your credit limit and pay your minimum balance on time. You may use this type of credit to buy anything within your credit limit. The most common items people use revolving credit for are things like groceries, gas, clothing, and other goods but some individuals also put automated bills on credit cards.

You may hear the term “open credit” when referring to charge cards. This type of credit is considered a type of revolving credit, however it needs to be paid in full at the end of each billing period, usually monthly. Because the balance must be paid off by the due date, this credit rarely appears on credit reports and doesn’t accrue interest charges. If the balance is not paid in entirety, however, there can be late fees, other penalties, and derogatory remarks on credit reports. Other examples of open credit are home equity lines of credit (HELOC) and and personal lines of credit.

Installment loans, also known as closed-end credit accounts, allow you to borrow a set amount of money and repay through fixed monthly payments for a specified period. They are usually used to purchase large items such as a home or a car or to cover student loan costs.

![]() Tip: While using a credit card to pay automated bills is an easy way to accrue points or other credit card rewards, many merchants charge additional fees to use a credit card. If the fee is greater than the associated points or rewards earned, use a fee free method instead.

Tip: While using a credit card to pay automated bills is an easy way to accrue points or other credit card rewards, many merchants charge additional fees to use a credit card. If the fee is greater than the associated points or rewards earned, use a fee free method instead.

How to Build Your Credit History

Building credit can be tricky, especially if you have little or no credit history. Often lenders may not be willing to offer you credit or will offer it with higher fees and interest rates, making it more challenging to pay off the debt. Having no credit history can impact your ability to get loans to go to school, open your first credit card, borrow to purchase a car, and rent an apartment.

![]() Definition: Credit Invisible

Definition: Credit Invisible

Credit invisible means that a person does not have a credit history with one of the nationwide credit reporting bureaus.

According to the Consumer Financial Protection Bureau, 26 million U.S. adults are “credit invisible.” As a result, these individuals have no credit scores. This is often because the consumer is just entering the credit world or because several types of payments they routinely make are not reported to the credit bureaus. Payments such as rent, utilities, and debts from small businesses may not be reported to a credit bureau. As a result, those payments are not included in the consumer’s credit report.

So, while the consumer may have a strong history of making payments, if the payments are not reported to the credit bureaus, this will result in the consumer’s credit being “invisible.” Don’t worry. Although it may seem complicated, there are ways to build your credit history. Consider these options:

- Get a secured credit card. A secured credit card is a special type of credit card that requires a cash deposit when you open the account. The money in your account serves as collateral every time you make a purchase. Your credit limit is typically set based on the amount of money you have in your deposit account. If you do not repay the debt, the lender may keep your deposit to recoup your unpaid balance.

- Get a store credit card. Many retail stores and gas stations offer credit cards that are used solely at their stores. Often you can apply to and gain approval on the spot. These types of credit are sometimes easier to acquire than traditional credit cards and they can be a good way to ease into building your credit history if you make small purchases and commit to paying them on time each month. But be careful. These vendor affiliated cards often have higher rates of interest. And while items like gas or purchases of clothes may seem small, they quickly add up. Remember that you are using these cards to build your credit history, not using them to casually buy things that create debt. So always try to pay your balance off each month.

- Become an authorized user. You can build your credit history by becoming an authorized user on the credit card of someone you trust. Only use this option for people you know will not take advantage of your finances and who consistently pay their debts. While not all card issuers report authorized user accounts to the three credit reporting agencies, some do. In such instances, missed payments and high credit utilization can reflect negatively on the authorized user’s credit report.

- Identify a co-signer or co-applicant. This is an individual who signs the note of another person as support for the credit of the primary signer and who becomes responsible for the obligation if it goes unpaid. Because this option puts someone you know at financial risk if you default by not paying back your debts, you should discuss and agree to how you will handle these issues should they arise before signing the dotted line.

- Explore student credit cards. Many credit cards companies offer college credit cards or cards for those who are just starting out. Often these cards do not require the same credit history standards as other cards and can be easier to acquire. But be very careful—these cards often come with very high interest rates and fees.

No matter what route you take to building your credit history, the most important tactic is to make payments on time each month. Even if you find that you cannot pay off your full balance— which is encouraged, always pay the minimum balance due. And if you find yourself in a financially challenged situation where you cannot pay, call your creditor to alert them of your difficulties. In some instances, they will work with you to come up with a payment plan, reduce the interest rate, or even decrease the balance.

How to maintain good credit

Once you have begun to build your credit history, you want to make sure you maintain it and keep it in good standing. This requires that you stay on top of your finances and debts. Here are some ways to help you maintain good credit:

- Pay your bills on time. Even when you cannot pay off the full balance, pay the minimum balance on time each month. Missing payments will impact your credit score and make it harder to access credit in the future or make the cost of your credit increase. Also, when debts go unpaid for 30 days after their due date, they’re considered delinquent. In these instances, your creditor will reach out to you to collect payment. If you ignore these communications or do not make payment, your creditor may sell your debt to a debt collector. This typically happens within 180 days of delinquency.

- Avoid maxing out your credit cards by keeping a low balance. The more money you owe on your credit card, the more interest you pay. Keeping a low balance will keep your debts manageable and easier to pay off. Also, many credit cards charge “over the limit” fees when you exceed your credit limit on your account. You never want more going out than coming in, so be mindful of your debt-to-income ratio so that you have enough money to pay off your debts.

- If you are paid more than once per month, consider making payments towards your debt every pay period. This keeps your credit utilization low and makes your payments smaller by dividing them across two paychecks rather than one.

- Check your credit score and credit reports at least once a year (free of cost). This helps you to know where you stand and what you need to do to improve your credit. Also, reviewing your credit report helps you to identify credit reporting errors and possible fraud that may be impacting your credit history.

- Develop good savings habits and establish an emergency fund. Saving is one of the most basic ways consumers can set themselves up for financial success. Having an emergency fund can help you be prepared for and avoid financial surprises that can cause significant financial setbacks.

![]() Definition: Debt Collector

Definition: Debt Collector

Debt collectors are collection agencies and companies (and sometimes lawyers) that collect debts. Often, they purchase your past-due debts from businesses or creditors and take on the responsibility of contacting you to receive payment.

Debt collectors typically contact you for two reasons:

- You are past-due on a debt and they want payment.

- Someone you know owes a debt and the debt collector is trying to locate them. According to the CFPB, as long as the collector does not reveal that they are collecting a debt or give details of the debt, it is legal for them to contact friends, family, and even someone’s work to find out how to contact you.

Some creditors have their own debt collection functions in-house, but because many sell your debts to other companies it can be confusing and difficult to know if they are legitimate. Always ask questions and confirm where the original debt came from and ask for and document the debt collection company’s name and address. When possible, review your files to confirm whether you owe the debt and how much you are past-due before giving a debt collector your money. If you find that you do not owe the debt or you’ve already paid it, be sure to contest the debt collection request in writing within 30 days of receiving information from the debt collector. Because debt collectors and creditors can report you to the credit bureaus and negatively impact your credit report and score, it is important that you document everything in a timely manner.

![]() Tip: The Consumer Financial Protection Bureau has sample letters that you can use to respond to a debt collector who is trying to collect a debt, and the sample letters include tips on using them. The sample letters may help you get information, set limits on communication, stop any further communication, and exercise your rights.

Tip: The Consumer Financial Protection Bureau has sample letters that you can use to respond to a debt collector who is trying to collect a debt, and the sample letters include tips on using them. The sample letters may help you get information, set limits on communication, stop any further communication, and exercise your rights.

![]() Tip: In some instances, debt collectors may repeatedly call and contact you to collect past-due debts. However, you can ask them to stop contacting you. While this will not prevent them from suing you or reporting the debt to a credit reporting bureau, it should stop any harassing or repeated calling. Be sure to put your request to any debt collector in writing.

Tip: In some instances, debt collectors may repeatedly call and contact you to collect past-due debts. However, you can ask them to stop contacting you. While this will not prevent them from suing you or reporting the debt to a credit reporting bureau, it should stop any harassing or repeated calling. Be sure to put your request to any debt collector in writing.

The Fair Debt Collections Practices Act is a federal law that governs practices by third-party debt collectors. This law gives consumers protection against predatory practices such as calling you late at night, using harassing language, and pursuing you for a debt you do not owe. Knowing and exercising these rights can help you gain control of your dealings with debt collectors.

![]() Activity: Paying off debts

Activity: Paying off debts

Sit down and write a list of all your debts. Be sure to list what company is owed (such as your credit card company or lender), how much you owe (the balance), the interest rate on the debt, your minimum monthly payment, and payment due date. Also, look at your monthly income and compare it to your fixed expenses, then determine how much you can pay over the minimum on credit card debts. If possible, commit to setting aside a designated amount each month to pay down debts.

Monthly Debts:

| Monthly Income | Blank |

|---|---|

| Monthly Expenses: | Blank |

| Credit Company/Lender | Balance | Interest Rate | Monthly Minimum | Due Date |

|---|---|---|---|---|

| Blank | Blank | Blank | Blank | Blank |

| Blank | Blank | Blank | Blank | Blank |

| Blank | Blank | Blank | Blank | Blank |

| Blank | Blank | Blank | Blank | Blank |

| Blank | Blank | Blank | Blank | Blank |

| Blank | Blank | Blank | Blank | Blank |

| Blank | Blank | Blank | Blank | Blank |

| Total | Blank | Blank | Blank | Blank |

Now that you know how much you owe each month on installment loans and how much you will pay towards your credit card debt each month, you can put your plan in action.

Next, set up automatic payments with your credit union or bank. This will ensure that what you owe is debited from your accounts each month on the same day— helping you to illustrate a track record of paying on time and creating a routine payment habit. If you prefer not to use automatic payments, you can also set up alerts or calendar reminders on your mobile device to remind you that a bill needs to be paid on a certain date each month.

Section II: Credit Reports

What is a credit report and what’s on it?

A credit report is a statement that has information about your credit activity and current credit situation. It gives the story of your credit history and contains information about where you live, how you pay your bills, whether you’ve been sued or arrested, or have filed for bankruptcy. These reports are a record of your credit history that include information about your identity, existing credit, public records, and inquiries about you. Your name, address, full or partial Social Security number, date of birth, and possibly employment information, are commonly reflected on the report. Current and fully paid or closed credit obligations will be listed, such as credit card accounts, mortgages, car loans, and student loans. It may also include the terms of your credit, how much you owe your creditors, and your history of making payments.

Credit reporting agencies sell the information in your report to lenders, employers, financial companies, and other businesses that use it to evaluate your applications for credit, insurance, employment, or renting a home.

The Fair Credit Reporting Act protects information collected by consumer reporting agencies such as credit bureaus, medical information companies, and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act. Companies that provide information to consumer reporting agencies also have specific legal obligations, including the duty to investigate disputed information. In addition, users of the information for credit, insurance, or employment purposes must notify the consumer when an adverse action is taken based on such reports.

How do I get a copy of my credit report?

The Fair Credit Reporting Actentitles you to a free annual credit report from each of the three credit reporting bureaus – Equifax, Experian, and TransUnion. Additionally, if you are denied credit or have an adverse action, you are entitled to a free credit report from the credit bureau who provided the report used in the creditor’s decision. For example, if the lender reviewed your TransUnion credit report to process your application, you are entitled to a free TransUnion credit report.

In September 2023, the three credit reporting agencies agreed to offer free credit reports weekly instead of once per year to encourage consumers to regularly check their credit data and build and protect their financial health.

AnnualCreditReport.com is the only authorized online source under federal law that provides free credit reports from the three major national credit reporting bureaus. While other websites may lead you to getting your credit report, they sometimes require a fee, try to sell you unnecessary products, or get you to sign up for “free” trials that charge your credit card in the future. AnnualCreditReport.com allows you to pull all your credit reports with no surprise fees. You can request your credit report by doing the following:

Visit AnnualCreditReport.com where you can view and print your credit report online.

Call 877-322-8228 to make a request. Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

How to read your credit report

![]() Build Knowledge. Knowing how to read your credit report is key to ensuring there are no inaccuracies that may be impacting your credit. Always read your credit report thoroughly and make sure that everything from your name and address to each account and debt balance are correct. If you see any errors, accounts you did not open, or incorrect balances, immediately contact the credit reporting agency you received the report from.

Build Knowledge. Knowing how to read your credit report is key to ensuring there are no inaccuracies that may be impacting your credit. Always read your credit report thoroughly and make sure that everything from your name and address to each account and debt balance are correct. If you see any errors, accounts you did not open, or incorrect balances, immediately contact the credit reporting agency you received the report from.

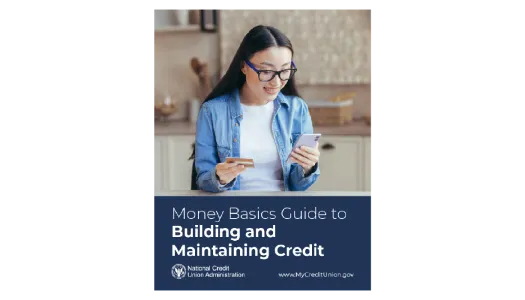

Here is an example of a credit report and the items you should look for when you review.

Personal Information

- Your name and any name you may have used in the past in connection with a credit account, including nicknames

- Current and former addresses

- Birth date

- Social Security number

- Phone numbers

Credit Accounts

- Current and historical credit accounts, including the type of account (mortgage, installment, revolving, etc.)

- The credit limit or amount

- Account balance

- Account payment history

- The date the account was opened and closed

- The name of the creditor

Public Records

- Liens

- Foreclosures

- Bankruptcies

- Civil suits and judgments

- A credit report may include information on overdue child support provided by a state or local child support agency or verified by any local, state, or federal government agency.

Collection Items

Inquiries

- Companies that have accessed your credit report.

![]() Tip: Check your credit report regularly to ensure there are no errors or instances of fraud.

Tip: Check your credit report regularly to ensure there are no errors or instances of fraud.

![]() Fact: Checking your own credit report will not hurt your credit score. While hard inquiries—this is when a financial institution checks your credit when making a lending decision—can impact your credit score, there is no effect on your credit score if you choose to request that information. Similarly, if a potential employer ran a credit check on your credit history, that would not impact your credit score. These are known as soft inquiries.

Fact: Checking your own credit report will not hurt your credit score. While hard inquiries—this is when a financial institution checks your credit when making a lending decision—can impact your credit score, there is no effect on your credit score if you choose to request that information. Similarly, if a potential employer ran a credit check on your credit history, that would not impact your credit score. These are known as soft inquiries.

How do I dispute errors on my credit report?

Finding errors on your credit report is not uncommon. It’s important that consumers thoroughly review their credit reports to spot mistakes and instances of possible fraud. Here’s a list of common errors to look out for:

Identity errors

- Incorrect name, phone number, and address

- Incorrect accounts that have been opened due to identity theft

- Debts from people with the same or a similar name as you. Always check to ensure that questionable accounts on your file do not actually belong to someone else

Incorrect account status

- Showing closed accounts as open

- Incorrect account balance or credit limit

- Debts listed more than once

- Incorrect date of last payment, date opened, or date of first delinquency

- Authorized users being reported as account owners

- Accounts that are incorrectly reported as late or delinquent

Data Errors

- Accounts that appear multiple times, often with different creditors

- Incorrect information that has been disputed reappears on your credit report

If you identify any errors on your credit report, you should immediately contact the credit reporting bureau that provided your credit report. If the error is related to an account that you did not open, should be closed, or the outstanding balance is incorrect, be sure to contact that company to file an official dispute and get a documented explanation of the issue.

If either the credit reporting bureau or the financial institution are unable or unwilling to resolve the issue, you can file a complaint with the Consumer Financial Protection Bureau.

Activity: Check your credit report

Visit AnnualCreditReport.com to request copies of your credit report. Once you have copies of your credit report, use this checklist to help you review your credit reports. Be sure to read through each item that is listed from your personal information like name and address to all the credit information that is listed. You can use a highlighter, marker, or pen to circle or highlight any items that are incorrect or questionable. If you are not sure about an item, cross check it with any records you may have filed away like old bills or statements. If you find any errors, immediately report them to the credit reporting bureau and financial service provider associated with the error (like your mortgage lender or credit card company). Be sure to have them respond to you in writing so that you have a record of the issue and how it is being handled.

Identity theft

Identity theft is one of the most common and costly scams in the United States. It impacts everyday people no matter their age, background, or financial savvy.

Identity theft occurs when someone uses your personal information without your permission.

They might steal personal information like your:

- Name

- Date of birth

- Social Security number

- Bank account number

- Credit card number

- Health insurance account numbers

And they could use your personal information to:

- Buy things with your credit cards

- Get new credit cards in your name

- Open a phone, electricity, or gas account in your name

- Steal your tax refund

- Use your health insurance to get medical care

- Pretend to be you if they are arrested1

How to tell if someone is using your identity

There are multiple signs that may signal that someone is using your identity. The Federal Trade Commission recommends that you keep your eyes out for the following:

- Debt collection calls for accounts you did not open

- The IRS receives more than one tax form in your name

- There are transactions on your credit card or bank statement you did not make

- You receive bills for items you did not purchase

- There are accounts on your credit report you did not open

Identity theft can have a detrimental impact on your credit and, in many cases consumers don’t know it has happened until they are bombarded by debt collection calls, check their credit report, or realize their credit score has dropped.

If you discover you have been the victim of identity theft, here are steps you can take:

- Contact the credit reporting bureaus and place a fraud alert or security freeze on your credit report and request that they block or remove fraudulent debts

- Report identity theft with the Federal Trade Commission’s https://www.identitytheft.gov and get assistance with a recovery plan.

Protect documents that have personal information

Always keep your financial records, including Social Security and Medicare cards, and any other important documents that have personal information in a safe place. When you decide to get rid of such documents, shred them and then throw them away. Never put documents with personally identifiable information or important financial information in the trash because someone could go through your trash and use that information to steal your identity. If you don’t have a shredder, check if your local community has a shred day where you can take your documents so they can be shredded and disposed of properly.

Protect your Social Security number

There are times when you will need to provide your Social Security number. But it can be hard to know whether it is safe to do so. Government agencies like the IRS, or your bank and employer may require your Social Security number. But typically, they will not make these requests by phone, email, or text you to ask for it. When in doubt, ask questions:

- Why do you need it?

- How will you protect it?

- Can you use a different identifier?

- Can you use just the last four digits of my Social Security number?

In instances where you are not confident a request is legitimate or safe, go to the organization’s official website and contact them directly to ensure you are communicating with an official representative.

How to check if credit has been opened in your child’s name

While most minors do not have credit on record, there are instances where this can happen. In such cases, these minors may have a credit report that can be pulled for review. Such instances include:

- Identity theft – Someone, perhaps a family member, has taken out credit in the minor’s name using their social security number, date of birth, and/or address. Often, they’ll take out credit cards or loans, open bank accounts, or even rent a place to live.

- Authorized users or joint account holders – In some cases, parents or other family members give children access to an account before they turn 18.

If you are concerned that your child has been the victim of identity theft, you can contact the three credit reporting bureaus (TransUnion, Equifax, and Experian) to have them run a report in their databases. To start the process, send a letter with your request to the addresses shown below with copies of the following:

- A copy of the child’s birth certificate

- A copy of the child’s Social Security card or a document from the Social Security Administration showing the child’s Social Security number

- A copy of your driver’s license or government-issued identification, with current address

- If you are not the child’s parent, a copy of a document giving you legal authority to act on the child’s behalf, such as a foster care certification or proof of legal guardianship

Send your information to:

Equifax Information Services LLC

P.O. Box 740241

Atlanta, GA 30374-0241

TransUnion

P.O. Box 2000

Chester, PA 19016

Experian

P.O. Box 2002

Allen, TX 75013

Section III: Credit Scores

What is a credit score?

Your credit score is a three-digit set of numbers that reflects your creditworthiness based on the information in your credit report. It summarizes your credit history, which lenders use to help predict how likely it is that you will repay a debt and make payments when they are due. Lenders use credit scores to decide whether to grant you credit, the interest rate you will pay on a loan or credit card, and other terms of the credit you are offered.

When you apply for credit or a loan, your credit score allows you to get an answer faster. Credit scores help lenders make decisions based on financial factors, because they objectively measure the applicant’s risk profile. Higher scores are viewed as a lower credit risk to lenders, while a lower score indicates a higher credit risk.

Credit scores are based on information in your credit file at the time it is requested. Your credit file information varies between the credit reporting agencies because lenders may only report your credit history to one or two of the agencies. The information in your file changes from day to day, which means your credit scores will likely be different from day-to-day. Additionally, different credit scoring models provide different assessments of your credit risk (risk of default) for the same consumer and same credit file.

What goes into a score and how is it calculated?

There are various factors that go into making up your credit score. Each of the three credit reporting bureaus use different scoring models or formulas to tabulate scores, which is why you may find that your score varies slightly from one company to another. Here are a some of the factors that go into your credit score:

- Payment history – Your payment history is the most important factor in your credit score. The best way to maintain a strong payment history is to pay all your bills on time, even if you only make minimum payments. Using autopay can help you stay on track in this effort.

- Credit utilization – This refers to how much of your available credit is used at any given time. Experts recommend keeping your overall credit utilization as low as possible. You can determine your credit utilization rate by dividing your total credit balances by your total credit limits on the day that it is reported to the credit reporting agency. Lower utilization rates indicate that you can use credit responsibly, while a higher credit utilization rate may lead to higher credit scores. Here are two tips to lower your credit utilization:

- Make multiple credit card payments throughout the month to keep your balance low. Your credit cards report to the credit agencies once a month so if you pay off some or all your balance before your due date, you will lower your credit utilization.

- If your income has increased and you have a strong credit history, consider asking for a credit limit increase. Be aware that this can sometimes result in a hard inquiry on your credit report.

- Credit history – Your credit history includes your credit accounts and how long you’ve had them, as well as foreclosures, bankruptcies, and debt collections. The longer you have kept accounts in good standing, the higher your credit score will be, provided you do not regularly open new accounts.

- Credit mix – This refers to how many forms of credit you have (credit cards, auto loans, mortgage loans, retail accounts, etc.).

- New credit – Recent additions to your credit and outstanding credit applications can be an indication that you are over-extended. While it is okay to apply for new credit, plan your borrowing so you do not have multiple applications or new accounts at one time. This will help you to minimize the negative impact it could have on your credit score.

What is a good credit score?

Credit scores range from 300 (very poor) to 850 (exceptional). However, because there are numerous scoring models with different scoring ranges and each of the three nationwide credit bureaus has its own variation, your score can vary.

A good credit score typically falls between 670 and 739, while an exceptional score measures 800 and above. So, the higher the credit score, the lower the perceived credit risk. Keep in mind, however, each lender has its own standards and approval process. There is no single or uniform “cutoff score” used by all lenders. Many additional factors are considered to determine actual loan terms and interest rate.

Credit is a convenience, and the cost of that convenience is the interest you pay on your debt. The lower your credit score, the higher your interest rate. Higher interest rates mean higher payments. A “good” score is subjective, because it really depends on how much credit you are applying for, from whom and for what. For example, a “good” credit score to buy a house may be very different than a “good” score to get approved for a rental.

Where to get your credit score

The three credit reporting bureaus provide credit scores for a fee. You can make a request for your credit score online and by phone.

- Equifax: Call 1-800-685-1111 or

Visit www.equifax.com - Experian: Call 1-888-397-3742 or

Visit www.experian.com/consumer-products/credit-score.html - TransUnion: Call 1-800-493-2392 or

Visit www.transunion.com/credit-score

In some instances, your credit union, credit card company, lenders, or non-profit credit or housing counselors may also offer your credit score for free. However, these are not always the same as the ones you would get from credit reporting agencies. These “educational credit scores” are intended to help you keep track of your score.

What to do when your credit score is low

If you’ve checked your credit score and found that it is low, start taking the steps listed in the “How to maintain good credit” section of this guide. The most important tool in building good credit is paying bills on time each month and paying off anything that is past-due or in collections. If you do these things, your credit score will increase over time and depending on your unique financial situation it can rise as quickly as 30-45 days, but may also take a few years.

![]() Fact: Certain things can have long term effects on your credit. For example, foreclosures and short sales can impact your credit for 3-7 years. While bankruptcies can negatively impact your credit for 7-10 years.

Fact: Certain things can have long term effects on your credit. For example, foreclosures and short sales can impact your credit for 3-7 years. While bankruptcies can negatively impact your credit for 7-10 years.

Can someone get a credit report or score if they are not a U.S. citizen?

If you are not a U.S. citizen and have credit activity and it has been reported to the credit reporting bureaus, the credit reporting bureaus are able to create a credit report for you. However, reporting is up to the business that gave you the loan or credit, and some creditors may not report all activities or may not report to all three companies. Credit information from other countries is typically not reported to the three U.S. based credit reporting bureaus.

AnnualCreditReport.com requires you to enter your Social Security number to access your free credit report. If you do not have a Social Security number, you may be able to receive your credit report from the individual credit reporting bureaus by phone, mail, or creating an account at their respective websites. Other personally identifiable information, such as an Individual Taxpayer Identification Number (ITIN), name, and address, may be used to find the credit activity associated with an individual and generate a credit report. You may be asked to provide a government issued ID, and additional documents such as a utility bill or bank statement displaying your current address. If your credit report contains enough information, you will likely also have a credit score.

Section VII: Conclusion

You now know the basics to building and maintaining good credit. What are three takeaways you learned from this guide?

We encourage you to continue building your financial knowledge by visiting MyCreditUnion.gov.

Sources:

1 https://consumer.gov/scams-identity-theft/avoiding-identity-theft