Money Basics Guide to Budgeting and Savings

About the Money Basics Guide Series

Welcome to the Money Basics Guide to Budgeting and Savings. The Money Basics Guides are a series of learning tools developed to assist financial educators, credit unions, and other financial institutions in their efforts to promote financial literacy in the communities they serve. These guides are also for everyday people who want to build their financial knowledge with practical skills they can use to manage their money.

Future guides will cover the basics of common financial topics, as well as emerging issues of consumer finance.

The Money Basics Guide to Budgeting and Savings is a great resource for group and individual learning. Whether you’re a financial educator who is building workshops for those you serve or you’re an individual focused on building your own financial knowledge and capability, these lessons and activities are for you.

Introduction to the National Credit Union Administration

The National Credit Union Administration (NCUA) is an independent federal agency created by the U.S. Congress to insure deposits at federally insured credit unions, protect the members who own credit unions, and charter and regulate federal credit unions. Part of our mission is to encourage financial literacy because we understand that when credit union members and consumers at large are more educated and informed, they’re better equipped to make the best financial decisions for themselves and their families. The NCUA offers a variety of tools to support credit unions in their financial literacy efforts, as well.

Icon Key

Throughout the Money Basics Guide to Savings and Checking Accounts, you will find icons to help you identify important information. Keep an eye out for the following:

Tip

![]() Tips provide you with additional need to know information about a topic and may offer suggestions for next steps.

Tips provide you with additional need to know information about a topic and may offer suggestions for next steps.

Fact

![]() Facts highlight valuable data and research to help you understand the impact of a topic on consumers.

Facts highlight valuable data and research to help you understand the impact of a topic on consumers.

Definition

![]() Definitions help you to learn important financial language.

Definitions help you to learn important financial language.

Test Your Knowledge Activity and Activity

Activity icons signal there is an action you can take individually or in a group to build your comprehension on a section topic.

![]() Test Your Knowledge Activity

Test Your Knowledge Activity

![]() Activity

Activity

Throughout the Money Basics Guides you will find the following icons which tell you what skills you will acquire:

![]() Building Knowledge

Building Knowledge

![]() Building New Habits

Building New Habits

![]() Building for the Future

Building for the Future

![]()

Section I: Why having a budget is essential

Developing a budget can feel scary for many consumers. It requires you to be proactive about your financial situation, and for many people, it can be hard to face. But having a budget is crucial to managing your money, staying out of debt, and ultimately building wealth.

More than anything, budgeting helps you keep track of what money is coming in and what is going out of your pocket—also known as your income and expenses.

Income versus Expenses

![]() Income: Your income is the money you receive on a regular basis. This typically comes from your employer but it can also be from investments, retirement benefits like a pension, social security or disability, among other sources.

Income: Your income is the money you receive on a regular basis. This typically comes from your employer but it can also be from investments, retirement benefits like a pension, social security or disability, among other sources.

![]() Expenses: Expenses are the costs required for the items and services you use and depend on. For example, your rent, groceries, and gas are all expenses you must pay for.

Expenses: Expenses are the costs required for the items and services you use and depend on. For example, your rent, groceries, and gas are all expenses you must pay for.

Having a budget allows you to have a clear view of your income and expenses all in one place. And it helps you to be less likely to:

- Be surprised by the costs of living

- Overspend and live beyond your means

- Get behind on bills

And you’re more likely to:

- Live within your income

- Be able to save

- Plan and build for future goals

Section II: Developing your budget

This first step to developing a budget is gathering all your financial information.

![]() Activity: Find your most recent pay stubs, bills, monthly credit union or bank account statements, and a highlighter or marker. Consider whether you have any of the following:

Activity: Find your most recent pay stubs, bills, monthly credit union or bank account statements, and a highlighter or marker. Consider whether you have any of the following:

Income

- Employment

- Freelance jobs

- Retirement benefits

- Disability payments

![]() Tip: If your income is consistent, you only need one, but if it fluctuates, use 2-4 pay stubs and calculate your average take-home pay. To calculate your average, add your income from each pay stub and divide it by the number of pay stubs you used. For example, You made $500, $400, $300, and $450 on your last four paychecks, which equals $1650. Now divide $1650 by 4, which equals $412.50.

Tip: If your income is consistent, you only need one, but if it fluctuates, use 2-4 pay stubs and calculate your average take-home pay. To calculate your average, add your income from each pay stub and divide it by the number of pay stubs you used. For example, You made $500, $400, $300, and $450 on your last four paychecks, which equals $1650. Now divide $1650 by 4, which equals $412.50.

![]() Tip: You may notice two types of income on your paystubs and wonder why one doesn’t add up to your salary. That’s because you have a gross and net income.

Tip: You may notice two types of income on your paystubs and wonder why one doesn’t add up to your salary. That’s because you have a gross and net income.

Gross income represents your earnings before taxes and other deductions.

Net income is your take-home pay after taxes and deductions. Always calculate your budget based on your net income.

Expenses

- Rent or mortgage

- Insurance

- Electricity

- Gas (Home)

- Water

- HOA

- Car payment or public transportation costs

- Gas (Car)

- Parking

- Cable

- Internet

- Cell Phone

- Groceries

- Entertainment (Going out to eat, movies, concerts)

- Self-care and maintenance (Hair salons, nails, etc.)

- Debts (Student loans, taxes, etc.) □ Family expenses (Day care, tuition, child support, alimony, etc.)

- Donations

- Miscellaneous (These expenses come up occasionally, like buying detergent, paying for tickets, etc.)

- Savings

- Anything else?

Now that you have all your monthly income and expenses let’s calculate them into your budget. Use this budgeting chart to get started.

Monthly Income

| Income Type | Income in Dollars |

|---|---|

| Paychecks (salary after taxes, benefits, and check cashing fees) | $ |

| Other income (after taxes for example: child support) | $ |

| Total monthly income | $ |

Monthly Expenses

| Expense Type | Expense in Dollars |

|---|---|

| Gas | $ |

| Water and sewer | $ |

| Cable | $ |

| Internet | $ |

| Waste removal | $ |

| Maintenance or repairs | $ |

| Vehicle payment | $ |

| Gas for vehicle | $ |

| Bus/taxi fare | $ |

| Insurance | $ |

| Licensing | $ |

| Maintenance | $ |

| Groceries | $ |

| Dining out | $ |

| Medical expenses | $ |

| Hair/nails | $ |

| Clothing | $ |

| Dry cleaning | $ |

| Health club | $ |

| Social or professional organization dues or fees | $ |

| Credit card debt | $ |

| Legal fees | $ |

| Alimony | $ |

| Retirement account | $ |

| Investment account | $ |

| Tuition or student loans | $ |

| Pet Food | $ |

| Pet Medical | $ |

| Pet Grooming | $ |

| Miscellaneous | $ |

| Total monthly expenses | $ |

![]() Tip: Add up your monthly net income, which will likely be from two paychecks.

Tip: Add up your monthly net income, which will likely be from two paychecks.

After completing your budget, did you have money left over each month? Or did you find that you are coming up short? Maybe you discovered you could keep up with all your expenses, but there isn’t much left over for miscellaneous costs or emergencies.

Needs vs. Wants

If you’ve found that your income isn’t going as far as you would like, it may be time to reconsider the items in your budget that are eating away at your money. Consider what items in your budget are needs and wants. Needs will be things like paying for rent or a mortgage because you need a roof over your head. But things like dining out are wants, and they can add up.

![]() Activity: List 3-5 items in your budget that are wants. How might you eliminate these wants or cut down on them to increase the money you hold on to each month?

Activity: List 3-5 items in your budget that are wants. How might you eliminate these wants or cut down on them to increase the money you hold on to each month?

![]() Tip: This could be a great opportunity to engage in a group discussion amongst students and other participants.

Tip: This could be a great opportunity to engage in a group discussion amongst students and other participants.

Section III: Committing to your budget

You now have a clear illustration of your current financial situation—which means you are on your way to taking charge of your financial future. But this is just a first step. Now you must keep going by having a strategy for spending within your means and sticking to it. Some people find it helpful to have separate checking accounts for bills and miscellaneous spending. In contrast, others find it is useful to use cash for miscellaneous expenses so that once they run out of physical money, they know they’re stepping outside their budget. No matter the strategy, find one that works for you.

Also, establish a monthly check-in with yourself or your family to review your budget and spending habits. This will help you assess if you’re sticking to your budget or need to readjust it.

![]() Activity: On your own, consider other ways to keep up with your budget. Set a calendar invite on your phone and commit to monthly and quarterly follow ups.

Activity: On your own, consider other ways to keep up with your budget. Set a calendar invite on your phone and commit to monthly and quarterly follow ups.

Section IV: Why you should be saving

We’ve all heard it before. “Save for a rainy day!” “Save for emergencies.” “Save for your dream home.” But for many consumers, saving feels impossible when you’re living on modest wages, in debt, or don’t know where to start.

That said, saving is one of the most basic ways consumers can set themselves up for financial success. While it typically doesn’t make you rich, it can help you be prepared for inevitable financial surprises that often cause significant financial setbacks.

Here are just eight reasons you should be saving:

- Emergencies and repairs – Cars break down, roofs collapse, and sometimes we have to deal with the cost of medical emergencies.

- Job loss – Without consistent income, many consumers may find that they can’t pay their bills or meet basic needs.

- Reduction in work hours – Sickness or injury can cause you not to work.

- Apartment rentals – Many landlords require you to have your first and last month of rent upfront, along with a security deposit which is often equal to one month’s rent.

- Buying a home – Homebuying can be expensive, especially because of its upfront costs like the down payment (which can be up to 20 percent of the home price, though not always) and closing costs.

- Education – The average cost of college at a public institution in the U.S. is just over $10,000 per year.1

- Retirement – Experts say you will need between 80 to 90 percent of your annual pre-retirement income to retire.2

- Funerals – The average cost of a funeral in the U.S. hovers around $7,800.3

While these expenses may seem overwhelming, imagine if you had a modest nest egg or emergency fund that could help to absorb the impact of some of these costs when they came up. That’s the value of saving.

Section V: Develop savings habits

Many people never start saving because they assume it requires them to put away a lot of money and deprive themselves of what they’re accustomed to. But saving isn’t about how much you save at all. It’s just about starting the habit.

Habits are more about discipline than the actual goal we’re trying to achieve. So, saving is a discipline you commit to as part of your daily routine and is key to sticking to a plan. Let’s start small.

![]() Activity: Set a 21-day savings goal Many people have heard the adage that it takes 21 days to start and commit to a new habit. Today, you are setting a 21-day savings goal. Can you commit to matching some of your “want” expenses when you make unnecessary purchases? For example, if you grab lunch that costs $12, can you put away an additional $12 in your 21-day savings challenge plan or piggybank? Maybe you like to take taxis and other car services around town that often add up to $17 a ride. Can you match that $17? Or perhaps you have more subtle wants, like your favorite cookies or potato chips brand. Try to match that $4 bag of goodies.

Activity: Set a 21-day savings goal Many people have heard the adage that it takes 21 days to start and commit to a new habit. Today, you are setting a 21-day savings goal. Can you commit to matching some of your “want” expenses when you make unnecessary purchases? For example, if you grab lunch that costs $12, can you put away an additional $12 in your 21-day savings challenge plan or piggybank? Maybe you like to take taxis and other car services around town that often add up to $17 a ride. Can you match that $17? Or perhaps you have more subtle wants, like your favorite cookies or potato chips brand. Try to match that $4 bag of goodies.

If you truly commit, you can save some money at the end of your 21 days. It may not be enough to buy a home, but it is enough to start a habit and build a savings fund.

Section VI: Setting a saving goal

Having goals is the only way to truly commit to saving long-term. Now that you’ve begun building your savings muscles let’s think about your goals.

![]() Activity: Set your goals Consider and list some of your short-term goals (6-12 months) and long-term goals (3-5 years).

Activity: Set your goals Consider and list some of your short-term goals (6-12 months) and long-term goals (3-5 years).

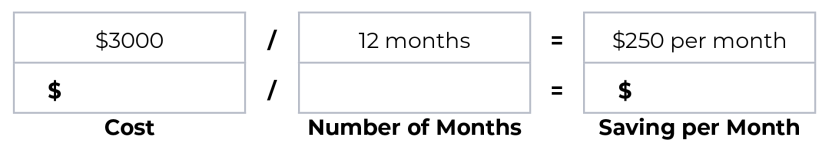

Choose one short-term goal and one long-term goal and calculate the following:

How much it will cost divided by how long it will take you to save in months. That total will tell you how much you need to save each month.

For example: Next year, (12 months from now) you want to take your family on vacation to Yosemite National Park. It will cost you $3000 in travel, lodging, food, gas, and passes. Calculate the following:

It’s important to be realistic about savings goals. If you’ve struggled to pay your bills, it may not be wise to focus on saving for expensive luxury items. But it may make sense to set a savings goal to help you get out of debt or have some emergency savings. Below list three actions you can take to help you stay committed to your savings goal.

Remember, saving and growing along your financial journey is not a sprint—it’s a marathon. It takes time to learn and commit to new habits. So even when you get off track, all you’ve got to do is start over and try again.

Section VII: Conclusion

You now know the basics to develop a budget, start good savings habits, and establish a savings goal. What are three takeaways you learned from this guide?

We encourage you to continue building your financial knowledge by visiting MyCreditUnion.gov.

Sources:

1 https://www.usnews.com/education/best-colleges/paying-for-college/articles/paying-for-college-infographic and https://nces.ed.gov/fastfacts/display.asp?id=76

2 https://www.merrilledge.com/article/how-much-do-you-really-need-to-save-for-retirement

3 https://www.forbes.com/advisor/life-insurance/how-much-does-a-funeral-cost/