How Do I Start Saving?

What’s Your Priority?

Save more, pay less. Loans and credit cards charge interest, and borrowing can be expensive. Avoid these costs by saving regularly.

Want To Start Today?

Helpful hints. Take simple steps to improve your financial future.

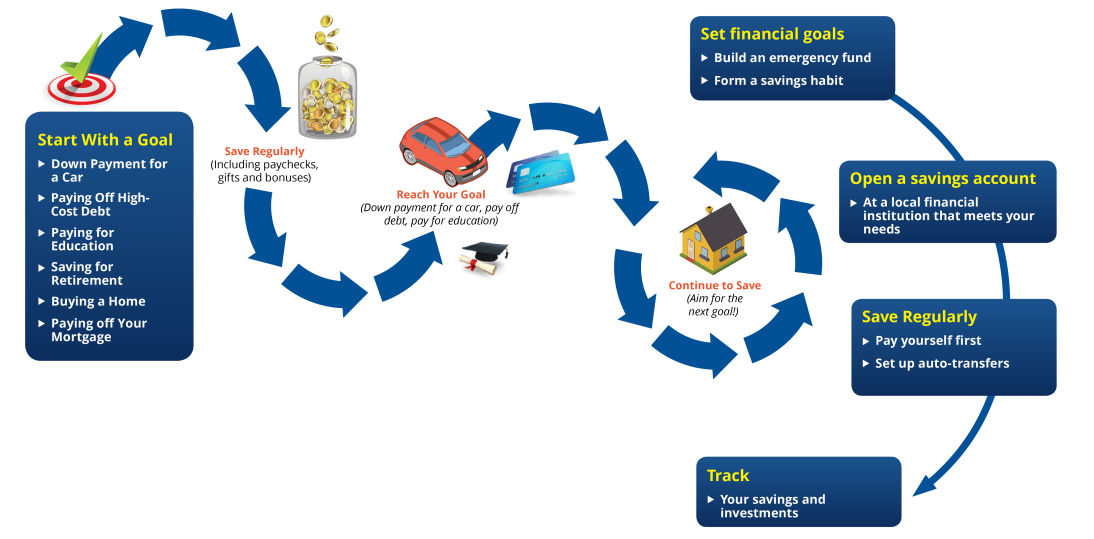

Start with a goal

- Down Payment for a Car

- Paying Off High-Cost Debt

- Paying for Education

- Saving for Retirement

- Buying a Home

- Paying off Your Mortgage

Set financial goals

- Build an emergency fund

- Form a savings habit

Open a savings account

- At a local financial institution that meets your needs.

Save regularly

- Pay yourself first

- Set up auto-transfers

Track

- Your savings and investments

How Can Credit Unions Help Me Save?

Credit unions typically offer:

- Higher savings rates

- Fewer fees

- Lower loan rates

Credit unions are not-for-profit, cooperative institutions owned by their members. For information on how to become a member of a credit union and to locate one near you visit MyCreditUnion.gov.

Federally insured credit unions offer a safe place for you to save your money. The National Credit Union Share Insurance Fund provides individual depositors up to $250,000 in coverage at each federally insured credit union.

Did You Know?

- In the U.S., 56% of individuals lack a rainy-day fund to cover expenses for 3 months.1

- About half of households age 55 and older have no retirement savings.2

- Children with small amounts saved for college, are 3 times more likely to enroll and 4 times more likely to graduate.3

Why Is It Important To Save?

Saving money early can help you become financially secure, give you peace of mind and provide a safety net in case of an emergency.

Start saving today by opening a savings account at a federally insured financial institution. Savings accounts make it simple and easy for you to save regularly.

To locate a federally insured credit union near you, visit MyCreditUnion.gov and click on the Credit Union Locator.

Educating Youth About the Importance of Saving

The NCUA’s interactive learning tools provide a fun platform for teaching young people about the importance of saving and spending wisely.

- World of Cents - For ages 5–10, this is an engaging, kid friendly tool that helps teach the value of money through the concepts of earning, saving, and spending money, while incorporating basic math concepts. Choose a character, select one of three math and matching skills levels, and participate in a vibrant world full of whimsical playhouses.

- Hit the Road - For ages 10–15, this is a fun and interactive platform for teaching young people money management skills. While on a virtual road trip across the country, you must save and spend your money wisely to complete challenges along the way.

Sources:

1 Financial Industry Regulatory Authority (FINRA). 2015 FINRA Foundation National Financial Capability Study.

2 Government Accountability Office (GAO). GAO-15-419 report published May 12, 2015.

3 Corporation for Enterprise Development: Scholarly Research on Children’s Savings Accounts (2014).